cc_advertiser_disclosure cc_editorial_disclosure

The number one way I stretch our travel budget to Disney World (and beyond) is by leveraging the points and miles I earn through credit cards.

Right now my #1 favorite travel rewards card – card_name – has an amazing welcome offer:

bonus_miles_full

Read on to learn all about using this card to earn points for travel or click here to go straight to the offer details. (P.S. Thanks for using my links and supporting my small business!)

How Does Travel With Points Work?

Vacation feels better when booked with points

Credit card companies are eager for your business, offering a “welcome bonus” to encourage customers to open a new card.

These welcome bonuses are an incredible way to earn travel with points by using the card for everyday spending and paying it off.

I’ve earned over $50,000 in flights, hotels, and more from my points and miles hobby, so we aren’t talking chump change here!

Chase Sapphire Preferred is my recommended card for first-timers because it is easy to get excellent value from the bonus.

The bonus is worth $750 when you redeem through Chase Travel®, or over $1,000 when you transfer your points to travel partners – read on to learn my favorites.

You’ll have to pay the annual_fees annual fee, but you’ll also get a $50 Annual Hotel Credit that helps offset that cost plus many other benefits.

And the rate at which you earn points is fantastic with Chase Sapphire Preferred, which is why I keep it in my wallet from year to year!

You’ll earn:

- 5X points on travel purchased through Chase Travel (SM)

- 3X points on dining, select streaming services, and online groceries

- 2X points on all other travel

- 1X point per dollar spent on all other purchases

Click here to learn how to apply.

One of MANY free flights I’ve taken with points and miles…

You’ll get travel benefits such as primary rental car insurance (rare for cards with around a $100 annual fee), trip cancellation/interruption insurance, and lost luggage insurance.

You’ll also get

- Complimentary DashPass membership for a minimum of one year (for $0 delivery fees on restaurant delivery)

- Six months of complimentary Instacart+ membership (for $0 delivery fee on grocery delivery) AND $15 quarterly Instacart statement credit through July 2024

I’ll show you how this process works in this post, but I have to mention that I don’t suggest using credit cards to earn points and miles unless you have a solid history of using credit responsibly.

If it would be hard for you to control your spending with credit cards and you would be prone to carrying a balance on these cards, then this isn’t the right pursuit for you.

How Do I Earn These Points?

Transfer points to Southwest for flights to Orlando and beyond

Here’s how to earn the welcome bonus with the Chase Sapphire Preferred card.

First, you won’t be approved for this (or any) Chase card if you have opened more than four new credit cards in the past twenty-four months.

This is called Chase’s “5/24 rule”.

Also, you won’t be approved for the bonus if you currently hold a Sapphire card or have received a welcome bonus for one in the previous 48 months.

However, you can still earn the bonus if you are listed as an authorized user on someone else’s card.

You can expect to receive your card in the mail within a week. You will be charged the $95 annual fee during the first month’s statement.

You’ll receive your bonus of points bonus_miles_disclaimer

I can easily do this by using the card for these purchases:

- Groceries

- Utilities

- Insurance

- Gas

- Any travel expenses for an upcoming trip

Your sign-up bonus points will be deposited into your Chase Ultimate Rewards account in about 5-7 days after the statement closes for the month in which you met the requirements (though your mileage may vary, this is just in my experience).

Click here to get more details on this card.

How To Redeem Your Points

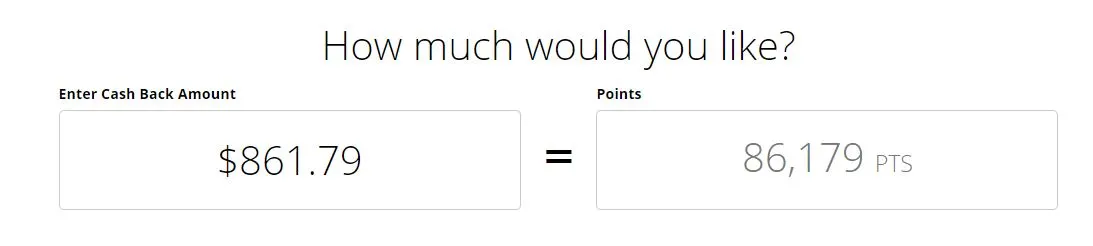

The easiest (though NOT the most lucrative) way to redeem your points is for cashback in the form of a statement credit.

You can get a dollar of statement credit for every 100 points you redeem.

For example, you could use your statement credit on discounted Disney World theme park tickets from Undercover Tourist.

You can also have the money deposited into your checking account if you’ve already paid off your balance!

Or you can take advantage of a 25% bonus when you book through the Chase Travel (SM) portal.

For example, when you book a flight or hotel stay through the travel portal and pay with points, 10,000 points will get you $125 worth of travel.

Unfortunately, Disney World resorts are very difficult to find in the Chase Ultimate Rewards portal.

But you can book many off-property resorts and condos and your flights to/from Disney World.

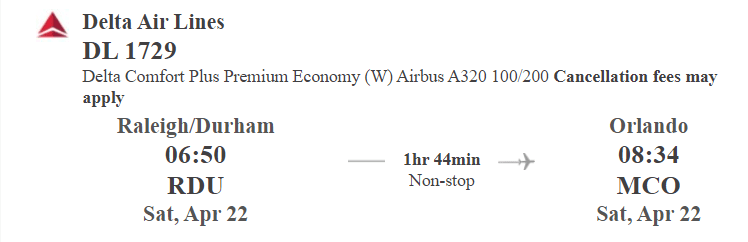

For example, here is a flight I booked in the Chase Ultimate Rewards portal for a trip to Disney World.

I redeemed 23,824 points for two tickets in Delta Comfort Plus (premium economy).

I love the flexibility of using my points for any airline – even ultra-low-cost carriers can be booked in the Chase Travel Portal.

It would be very easy to buy flights and hotels for your family vacation entirely with the points you earn from this card bonus.

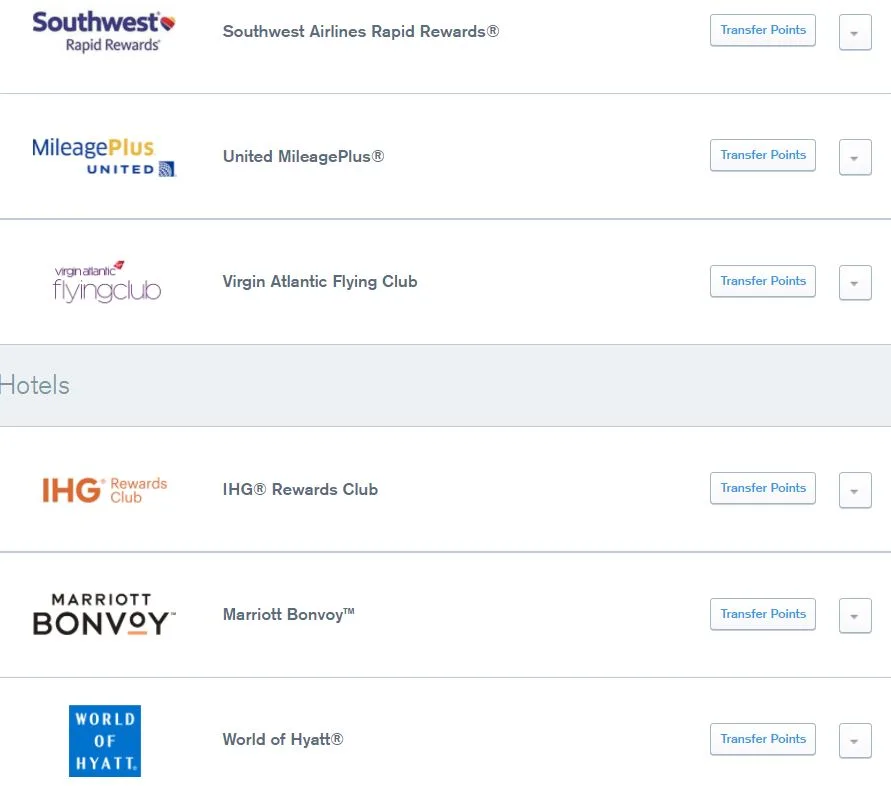

A third option for redeeming your points is to transfer them to a travel partner.

This is where you can get crazy value from your bonus points!

Transfer the points 1:1 to many airlines and three hotel partners (Marriott, Hyatt, and IHG).

If you want to fly to Orlando on Southwest, transferring your points into your Rapid Rewards account is a great way to stretch your points.

Stays at Hyatt properties represent an excellent value on points so I often transfer to Hyatt to stretch my points as well.

Fore example, this stay at my favorite Hyatt in Orlando gives a value of over 3 cents per point!

Transferring to partners such as Hyatt and Southwest can help you easily get over $1500 in value from your bonus.

I hope this post answered your questions about using the Chase Sapphire Preferred welcome bonus for your Disney World vacation.

Any questions? Leave a comment below!

Check out these related posts:

Walt Disney World Swan Hotel Review & How To Stay For Free

How I Regularly Fly To Disney World For Almost Free

cc_advertiser_disclosure cc_editorial_disclosure

Comment Disclosure: Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Janet

Monday 6th of May 2024

In your 5/6/24 email you wrote you stayed at a Disney All Star Resort using points from your Chase Sapphire Preferred. Please advise how to use Ultimate Rewards at Disney resorts. Thank you!

Leah

Saturday 11th of May 2024

I actually used Ultimate Rewards for the other hotel stay on our trip, at the Hyatt Place near Disney Springs. You can use UR for a Disney hotel stay but only by paying for the reservation with your CSP card and then redeeming UR for statement credit for the stay.

TeeGirl72

Sunday 5th of June 2022

I am looking at more ways to travel to Orlando (up to 3 or 4 times a year) with my family of 6. I obviously missed this option but I’d like more options and ways for flight because that is the only thing holding us back from more visits. Feel free to email me your response.

Amber

Wednesday 30th of June 2021

I have been considering getting a travel credit card for some time now. I currently have the Chase Disney CC and I'm finding that its really difficult to rack up the points. I have used my card consistently for EVERYTHING minus utilities since around 2019 (which is probably on average about $3000+ per month) and have only managed to accrue around $1000+ in Disney rewards which completely baffles me. I for sure thought I would have accrued MUCH more by now. (yes I pay it off every month, if not a couple of times/month with each paycheck)

I have looked into the Chase Southwest CC but this Sapphire Rewards really sounds fantastic and the fact that I could really use it for so much is very appealing to me.

What would you say is the best reason to go with Sapphire Rewards over the Chase Southwest card? (if its possible please just directly email me your response)